Opportunities rife for sports drinks makers in the Asia-Pacific

October 2023

Share this exclusive content from Saladplate

With Asia-Pacific emerging as the fastest growing region for sports drinks worldwide, beverage makers are vying to capture a slice of the lucrative market, says Bobby Verghese, Consumer Analyst at GlobalData.

Asia-Pacific – a sizable, albeit under-tapped market for sports drinks

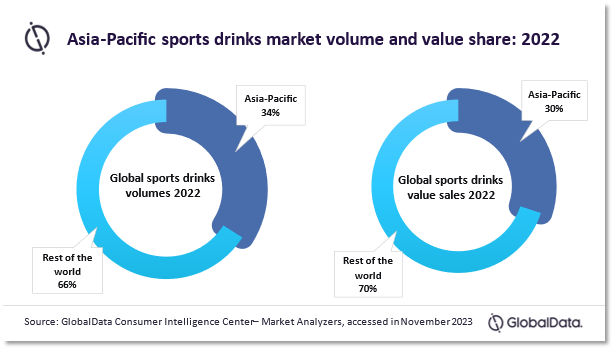

Sports drinks, or isotonic, hypertonic, or hypotonic drinks, are functional beverages typically formulated to replenish electrolytes and energy lost through sweat or enhance endurance during exercise and other strenuous activities. Sports drinks brands, such as Japan’s Pocari Sweat, have become household names in the Asia-Pacific (APAC) region over the last two decades. After North America, APAC was the second-largest geographic regional market for sports drinks in volume and value sales* primarily due to the region’s large population and rising household incomes. Within the APAC market, the top four countries, namely China, Japan, India, and Indonesia, accounted for almost three-quarters of sports drinks volumes in 2022*.

Photo Credit: L’Effervescence

Photo Credit: L’Effervescence

GlobalData projects the APAC sports drinks market to outpace all other regional markets by a huge margin over 2022–27 and displace North America as the largest global market by volume in 2027. However, owing to the high per capita consumer spending on sports drinks, North America will expand its lead in value sales over the Asia-Pacific through 2027*. China, India, and Vietnam are forecast to register the highest volume growth over 2022–27 in the APAC region*.

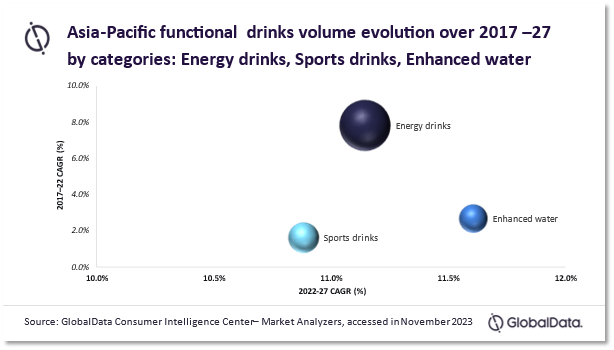

Sports drinks’ consumption lags behind energy drinks and enhanced water

Sports drinks recorded moderate growth over 2017–2022, tailing energy drinks, and enhanced water as the COVID-19 pandemic had a mixed impact on the category’s performance. As the COVID-19 lockdown and quarantines kept consumers away from gyms, parks, spas, swimming pools, and other sports and fitness centres, the demand for sports drinks plunged in 2020. Consumers confined to exercising at home were less likely to consume sports drinks. At the same time, as international and national health organizations emphasized the importance of staying hydrated to fight COVID-19 infections, sports drinks gained a healthy halo.

With the pandemic under control, and consumers resuming out-of-home exercise and fitness activities, the demand for sports drinks surged in 2022. Moreover, sports drinks brands that were confined to digital marketing during the COVID-19 outbreak, were once again able to launch large-scale marketing campaigns as international and regional mass-spectator sports resumed.

Photo caption: Chef Shinobu Namae’s signature dish “Fixed Point” is a symbol of the restaurant’s culinary evolution. | Photo Credit: L’Effervescence

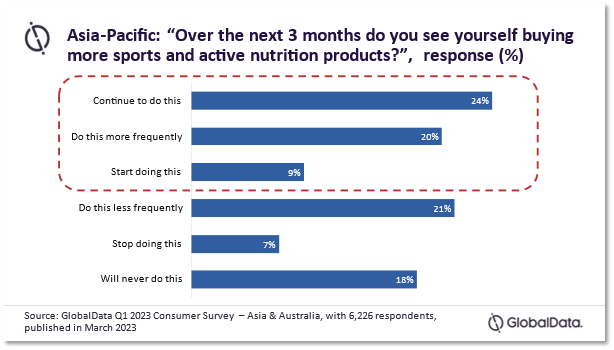

The rising health & wellness trend, stimulated by the pandemic, is expected to sustain this trend, enabling the category to register double-digit growth through 2027. This resonates with the findings of a GlobalData 2022 consumer survey, wherein 53% of APAC respondents said that they were buying more sports and active nutrition products, such as protein bars, and energy gels**.

Photo Credit: L’Effervescence

Product innovation rife in the sports drinks space

The top five manufacturers — the Otsuka Group (Pocari and Energen), The Coca-Cola Company (Powerade and Aquarius), Jianlibao Group (Jianlibao), PepsiCo (Gatorade and &-Up), and Fraser And Neave (100 Plus) – cornered over three-fourths of volume and value sales in 2022. Competition is expected to intensify over the next five years as more regional and multinational companies enter the space.

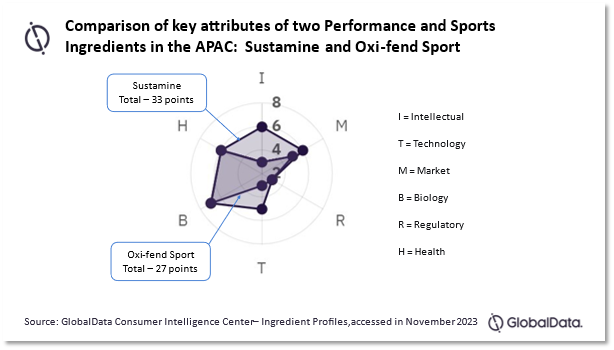

Product innovation is rife with food ingredient formulators developing complex clinical and biological active ingredients that can boost performance during strenuous workouts. Examples include New Zealand Extracts’ Oxi-Fend Sport, a blend extracted from grape seed and blackcurrant that purportedly reduces oxidative damage of muscle tissue during exercise, and Kyowa Quality Sustamine, an amino acid derivative that is said to stimulate muscle protein synthesis and rebuild glycogen stores. GlobalData’s Ingredients Profiles database compares the intellectual property, technological, market, biological, regulatory, and health attributes of these two ingredients, with Sustamine scoring higher than Oxi-Fend Sport.

Manufacturers are gearing up to launch novel products infused with caffeine, nootropics, and other brain-boosting ingredients targeting the lucrative e-gamers cohort, comprising high-spending youth. Moreover, in keeping with the growing natural healthy dietary trends, manufacturers are developing products with organic, clean-label, and free-from formulations with ingredients, such as coconut water, fruit juice, and natural sweeteners such as stevia and monk fruit. Recent product launches include Danone China’s Mizone Electrolyte +, an electrolytic drink with a coconut-water base; and Kirin’s Plasma Sports, a sports nutrition drink that received the coveted “Food with Function Claims” certification from Japan’s Consumer Affairs Agency. Similarly, Coca-Cola India debuted Limca Sportz ION4, which the company claims was formulated with its novel ION4 technology in September 2023.

Furthermore, local brands that are expanding their geographic presence across the APAC region and beyond, are launching customized products with localized ingredients and flavour profiles suitable for local palates. Besides product formulations, leading manufacturers are exploring sustainable packaging materials such as recycled PET, aluminium cans, and paper and board cartons to appeal to eco-conscious consumers.

Sports drinks manufacturers need to widen the consumer base

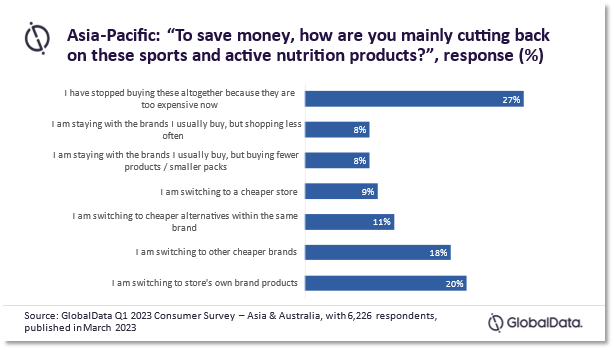

Sports drinks’ growth will also be underpinned by strong efforts of manufacturers to expand their consumer base. However, APAC consumers have become more price-sensitive in light of the inflationary pressures and economic uncertainties triggered by the ongoing Russia–Ukraine conflict and the recent Israel–Palestine conflict. This is corroborated by GlobalData’s 2022 survey, wherein most APAC consumers are rationalizing their purchase of sports and active nutrition products to save money**.

Manufacturers can attract more mass retail consumers to the category by rolling out low-priced brands or offering special discounts and deals on their existing brands. Additionally, sports drinks makers can introduce smaller pack sizes of their premium brands in the form of energy shots with pocket-friendly price tags. Companies can also launch loyalty schemes using QR codes printed on product packaging sleeves to build more brand loyalty and generate repeat purchases. As the macroeconomic and geopolitical turbulence eases, this mass retail consumer base can be incentivized to trade up to premium brands or larger-sized packs to boost both volume sales and revenue margins.

Author: Bobby Verghese,

Consumer Analyst at GlobalData

Source: GlobalData Consumer Insights

* GlobalData Consumer Intelligence Center – Market Analyzers, accessed in October 2023

** GlobalData Q3 2023 Consumer Survey – Asia & Australia, with 6,131 respondents, published in October 2023