Where are fast-food customers going? Check out the grocery store

Consumers may be visiting value-focused retail chains like Aldi and Dollar Tree rather than McDonald’s, and fast-casual brands may be losing customers to retail, too, according to Placer.ai data

24 September 2025

Share this exclusive content from Saladplate

Dollar Tree is selling more food and beverages. | Photo Credit: Shutterstock

McDonald’s may not be losing customers to Chili’s so much as it’s losing them to Dollar Tree.

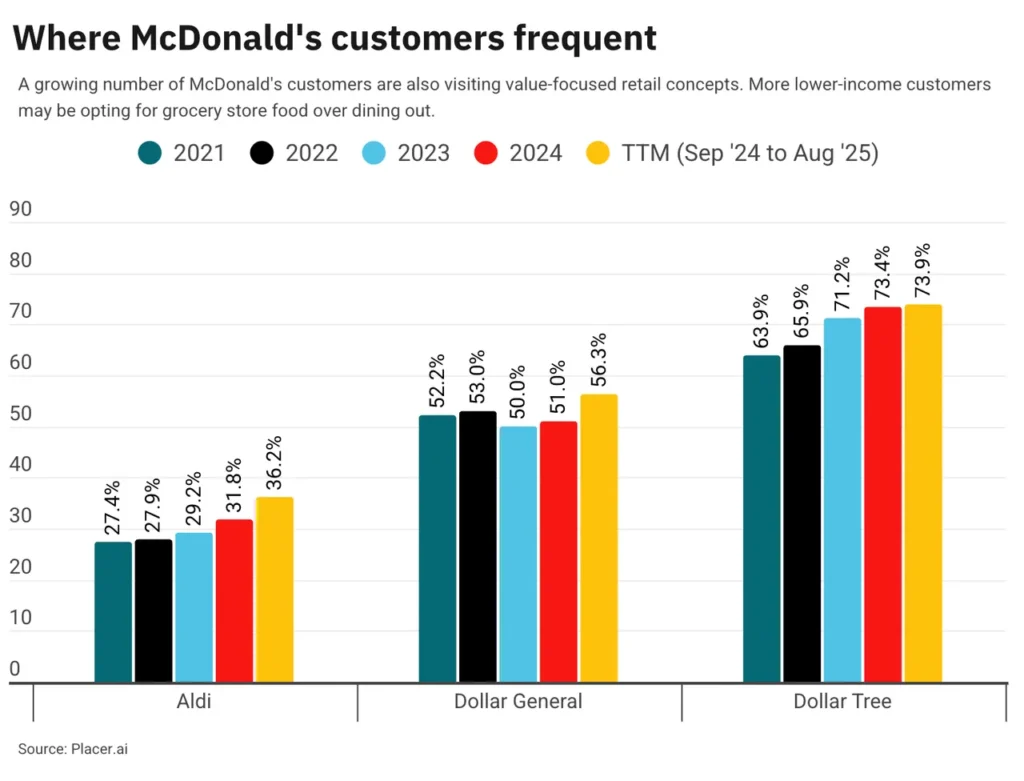

At least, that is according to newly released data from the foot traffic tracking firm Placer.ai, which noted that a higher percentage of McDonald’s customers are visiting value-focused retail grocers, including Aldi, Dollar General and Dollar Tree.

But it’s not just fast-food chains losing some business to the retail industry. Lunchtime visits to grocery stores are increasing, which Placer.ai suggests could be siphoning off customers from bowl-focused concepts such as Chipotle and Cava.

The data could help explain industry traffic pressure this year, which has expanded from major fast-food chains to larger fast-casual brands that had previously been able to avoid such downturns.

“There’s a lot of anxiety and unease with that low-income consumer,” McDonald’s CEO Chris Kempczinski said in August. “It’s clear from the data that, besides real income being down, that sentiment is down. And the result of that is you’re seeing people either skip occasions, so they’re skipping a daypart like breakfast, or they’re trading down either within our menu or they’re trading down to eating at home.”

The “eating at home” part is likely, if consumers are opting for cheaper fare. That has been a boon for budget-friendly retail options. Walmart’s same-store sales are rising in part to higher grocery sales.

According to Placer.ai, a growing percentage of McDonald’s customers also visit value-oriented retailers, which might be pulling some sales.

For instance, 36.2% of McDonald’s customers also visited the value-focused grocer Aldi so far this year, up from 31.8% last year and 27.4% in 2021. Nearly three-quarters, or 73.9%, of McDonald’s customers visited Dollar Tree so far this year, up from 73.4% last year and 63.9% in 2021. In each case, that percentage has grown every year.

Meanwhile, 56.3% of McDonald’s customers visited Dollar General this year, up from 51% last year.

Dollar Tree last quarter said it generated a 6.5% same-store sales increase, including 3% growth in traffic.

The retailer’s executives said they are getting more of their business from middle- and higher-income consumers.

More than half of Dollar Tree’s sales come in the form of “consumables,” or groceries. Those sales grew 6.7% last quarter.

Something similar may also be happening with fast-casual chains.

A growing percentage of consumers are visiting grocery stores around lunchtime. More than a quarter of visits to fresh-format grocers, 26.3%, come between 11 a.m. and 2 p.m. By contrast, 22.6% of visits to traditional grocers come during that period.

Placer.ai suggested that such visits could be coming at the expense of brands like Chipotle and Cava, both of which have seen a slowdown in same-store sales this year. While tough comparisons and so-called “slop bowl fatigue” may be playing a role, consumers tightening their spending and getting their bowls from grocers instead could have an impact, too.

Source: Supermarket News